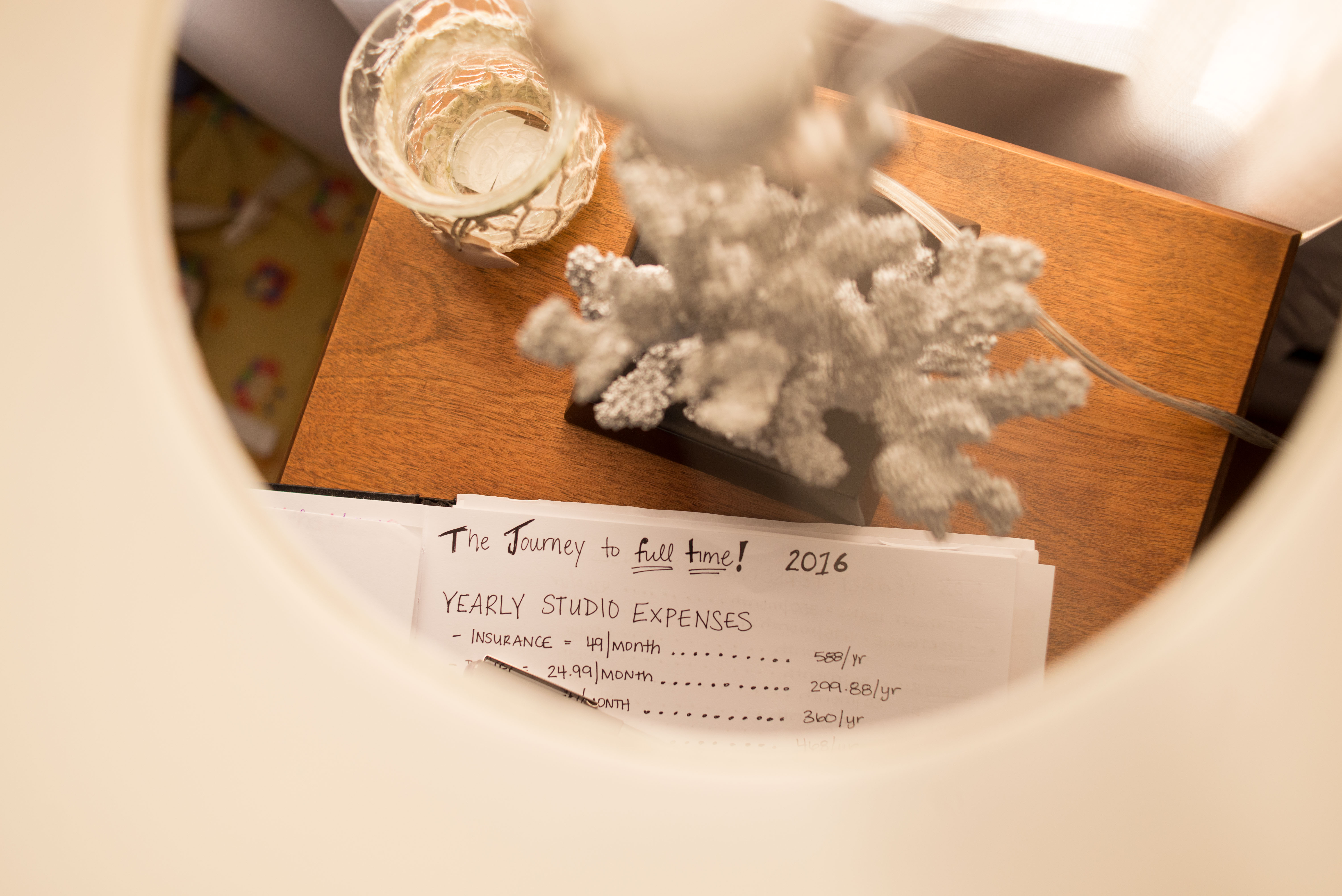

I’m still in disbelief some days that I get to live out my dream and give my business a shot at supporting my family full time! Back in December and January, before we had officially decided that I would stay at home and run my business, I started to do a LOT of brainstorming and crunching numbers. It helped me get ready for even the thought of transitioning to staying at home. Since the point where we decided I would do this, that WE would do this, I’ve been doing a lot of work to get ready for this. However, there are a lot of things to consider when making this transition!

Here are the things that I’ve realized and have been working on to make this transition as smooth as possible. I know that no matter how prepared we are, it’ll still be a shock to what we are used to and it’ll be a weird process!

- Health insurance. I have health insurance through my employer and it’s been great! But now I have to start thinking about and looking for other affordable health insurance options because come the end of August, I’m on my own for that! It’s something that a lot of people overlook! It’s important to have a plan in place ahead of time, and knowing how much it’s going to cost you so you can be prepared!

- Budget. I sat down and figured out how much money we spend a month on EVERYTHING, and how much we’ll probably spend in the future. I tried to think of everything from toll money, to date nights, random baby supplies, and still putting money into our emergency fund to keep building that up! Having this number in place was really good for me, because my goal is to pay for 50% of all personal expenses and bills from my business during the first year, and then 75% the second year, and then hopefully 100% by the third year! Right now my husband is working so I don’t have to cover 100% right away, which is a luxury that I know a lot of people don’t have, and I’m so thankful!

- Understand your business expenses. I also went through my business and figured out how I’m spending my money in my business. This was good for two reasons: I got a solid number of what I spend on each wedding and then just regular maintenance on my business, and it also helped me figure out where I can cut expenses that I don’t really need!

- Create a financial plan, and stick to it. For the first time ever, I sat down and determined how I was going to split up each and every payment between business bills, savings, taxes, and personal expenses. When I figured out how I planned to split it all up, it was really easy to stick to it. Now I feel really great because as soon as a payment comes in before I do anything, I split it up and put the money in the appropriate accounts! As part of my financial plan, I also determined the total of the costs of my business for a year, along with 50% of all personal expenses for one year to figure out how many weddings I needed to book and at what price point I needed to book them at!

- Save, save, save! It is really important to me to have a buffer in my business account and in my personal account before my paychecks from my day job stop rolling in. I determined a number for my personal account and a number for my business account, so that if I had ZERO money coming in for a few months I would still have everything covered!

- Reality check. At first I was paralyzed by fear of failing that I didn’t want to go full time for the longest time. But when I realized that the worst case scenario was that my business fails and I go back to working in education, the fear of failure wasn’t as intense. So, have a backup plan so that you know what you’re getting yourself into.

This isn’t THE way to do it. I don’t even know if it’s the right way to do it, but it’s what I’ve been working through and learning, and if this can be helpful to someone else, then great!

It’s a BIG deal to leave your day job and pursue your dream of running your own business, so it’s important to set yourself up for success as much as possible so you don’t become one of those small businesses that fail in the first five years! You can do it!! Also, if you’re someone who loves working a day job and running a business, then that’s okay too! Everyone’s dreams are different, and not everyone wants to go full time, and that’s OKAY. Just remember to stay true to you 🙂

If you liked this post, you might like these also!

[…] think that when I was preparing to go full time, I did a pretty good job getting myself ready for that. But, like with most things, there’s no way […]